What we do

Private Equity with Purpose

We do not compromise between positive impact and investment returns.

We back management teams to transform their businesses.

We think creatively and embrace complexity.

We are operational not financial.

We create long-term value through transformation.

Transformation

What we do

- We make transformational investments in defensible businesses. Transformational means we want to improve, grow and strengthen businesses.

- We work with management teams to develop a transformational business plan. The plan is multi-dimensional, focusing on all aspects of the business.

- We are operationally focused and want to grow the businesses we back.

- Our team of investment professionals is highly entrepreneurial with extensive experience in private equity, consulting and management.

- We are supported by a board of senior advisors and a network of industry experts who provide specific industry knowledge and insights, as well as introductions.

Sector expertise

What we like…

- Defensibility through high barriers to entry, significant market share, long-term customer relationships and unique resources.

- Regulation, licensing and certification in sectors with a stable and positive regulatory environment.

- A Pan-European view but where market features are local.

- Complexity of business model, of transaction, of ownership structure where a creative or differentiated approach is required.

- Opportunity for acquisitions, disposals, new market entry, new product development and operational optimisation.

The Agilitas team has a diverse set of skills and experience in private equity, M&A, consulting and operations, which allows the firm to make transformational investments. The team represents 13 European nationalities and collectively speaks 15 languages.

Alison Prout is an ESG Specialist Transformation Consultant at Agilitas, focusing on all aspects of Agilitas’s approach to responsible investment and sustainable value creation.

Alison has over 20 years of experience in the social sector and has worked on a broad range of social, environmental and development opportunities for investor networks, governments, NGOs and UN Agencies such as Ceres, the Institutional Investors Group on Climate Change, the United Nations Environment Programme and the World Wildlife Fund.

Amol Judge joined the investment team of Agilitas in 2020. He started his career in investment banking with Carnegie Investment Bank in Oslo and has been working in private equity since 2017 in Oslo and London.

Amol holds an MBA in Finance from the Norwegian School of Economics (NHH) and a BA in Economics from the University of Oslo. He speaks Norwegian, Danish, Hindi, Punjabi, Swedish, and English.

Anne-Claire de Pompignan is the Head of Investor Relations. She started her carrier in investment banking with Lehman Brothers. She has over 15 years of private equity and private debt experience, focusing on capital markets and investing private debt in pan-European mid-market buyouts.

Anne-Claire holds a postgraduate degree from University Paris-IX Dauphine. She speaks French, Spanish, and English.

Britanny Pillikse-Laidsaar joined Agilitas in 2022 as Office Manager and Team Assistant, having gained experience in similar positions in London and Australia prior to joining.

Claire Gomard joined the investment team at the beginning of 2024 and has 13 years of private equity experience.

Prior to joining Agilitas, Claire co-founded Care Capital, a private equity firm focusing on human capital as an accelerator of growth. She also worked at Apicap where she co-founded Women Leadership Capital, a fund dedicated to female-led businesses. Prior to that, she worked at Milestone Capital. She started her career in London at Société Générale.

Claire holds a Master in Financial Engineering from EMLyon and an MBA from Southeastern Louisiana University. She speaks French and English.

Debojit Mukherjee joined Agilitas as Chief Operating Officer in 2017. He has held similar roles with private equity firms in London since 2009. Prior to that, he spent three years with Carbon Capital Markets, having previously qualified as a Chartered Accountant. He started his career at Barclays Capital.

Debojit holds a BSc in Economics from University College London and is a fellow of the ICAEW. He speaks English and Bengali.

Eleanor Shaw joined Agilitas in 2024 as Corporate Financial Controller with more than 20 years of experience.

Prior to joining Agilitas, Eleanor was Financial Controller at Caxton Associates and Horizon Asset LLP. Prior to this, Eleanor was a Finance Business Partner at Barclays and an Accountant at IV Capital for seven years. Eleanor started her career at Société Générale Corporate and Investment Banking in London.

Eleanor has been a CIMA Qualified Accountant since 2010 and holds a Bachelor’s degree in Geography from the University of Exeter.

Hamza Ben Abderahmen joined the investment team of Agilitas in 2022. Hamza started his career in investment banking at JP Morgan and has been working in private equity since 2013, with a particular focus on developing geographies and impact investing. Prior to joining Agilitas, Hamza co-founded Si Advisers, a boutique firm focused on growth investments in Africa and the Middle East.

Hamza holds a Master’s degree in Management from ESCP Europe. He speaks French, Arabic and English.

Kevin Iermiin started his private equity career at Agilitas in 2014 as part of the investment team. Prior to joining Agilitas, he held investment banking roles in London and Copenhagen with Gudme Raaschou Investment Bank, Lehman Brothers, Nomura and Merrill Lynch. He also served as a First Lieutenant in the Royal Danish Army.

Kevin holds an MSc in Economics and Business Administration from Copenhagen Business School and speaks Danish, Swedish and English.

Martin Calderbank has been working in private equity since 1995 and is part of the founding team of Agilitas. With more than 25 years of experience in the industry, Martin focuses on the unique attribute of private equity over other equity models: the ability to support strong managers leading their companies through transformational change. Martin is the guardian of the firm’s culture, in particular the alignment of interest between shareholder value and the underlying purpose of the companies backed by Agilitas. Martin also oversees the quality of investment decisions and transformation stewardship.

Martin started his career with McKinsey. He holds an MBA from Harvard Business School, an MA in Mathematics from Cambridge University and an MA in theology from Durham University. He speaks English and French.

Matteo Recchia joined the Agilitas investment team in 2022. He started his career with PwC in Italy before joining a financial advisory firm. He then joined a private equity firm in London in 2016. Matteo was also the CFO of FairConnect Group.

Matteo is a CFA charterholder, a chartered accountant and auditor, and holds an MSc in Corporate Finance from the University of Bocconi. He speaks English and Italian.

Matthias Hansch joined the Agilitas team in 2023 as Head of Transformation with more than 20 years’ experience, working with management teams to deliver sustainable profitability improvements. He started his career at McKinsey, then Alix Partners before turning to Private Equity in Germany.

Nadja Goldbach joined the investment team of Agilitas in 2021. Prior to that, she was a management consultant for Kearney in Frankfurt and London, a strategy consultant for Monitor Deloitte and had worked for a technology-focused mid-market private equity firm based in Silicon Valley and London.

Nadja holds a MSc in Development Economics from the London School of Economics and a BA in Economics and Management from the University of Oxford. Nadja speaks German, French, Spanish and English.

Niklas Quadt joined the investment team of Agilitas in 2021. Niklas has been working in private equity since 2018. Prior to that, he worked for management consulting firm Oliver Wyman in London and Munich.

Niklas holds an MBA from London Business School and a BSc in Business Administration and Management from the University of Mannheim in Germany. Niklas is fluent in German and English.

Panos Loizou is a Specialist Transformation Consultant and is part of the founding team of Agilitas. He has held senior non-executive roles in private equity firms since 2000, contributing operational and restructuring expertise. Panos started his career with OC&C and held executive positions at GE and Pepsico.

Panos holds an MBA from IMD Business School and a PhD and BSc in Mechanical Engineering from the University of Manchester Institute of Science and Technology. He speaks Greek and English.

Philip Krinks is an ESG Specialist Transformation Consultant, focusing on all aspects of Agilitas’s approach to responsible investment and sustainable value creation. Prior to Agilitas, Philip spent 15 years at Boston Consulting Group (BCG). He also spent ten years as Director at The Saint Martin’s Partnership helping social enterprises, charities, and public bodies to grow and develop sustainably through expertise in finance, planning, management and organisation.

Philip holds an MA in Classics from Oxford, an MBA from INSEAD and a PhD in Ethics from London University.

Saad Akram is a Specialist Transformation Consultant at Agilitas focusing on sourcing and executing acquisition and financing opportunities within portfolio companies. Previously he held investment banking roles at HSBC, Merrill Lynch and Barclays, and started his career as an engineer at Nokia.

Saad holds an MBA from The University of Chicago Booth Business School and an MSc in Engineering from the Technical University of Denmark. He speaks both Danish and English.

Sandra Jacobsson is a team assistant. Before joining Agilitas in 2019, Sandra worked in sales and administrative positions within the fashion and technology industries.

Sandra speaks Swedish and English.

Torbjorn Midsem is part of the founding team of Agilitas and has more than 20 years of private equity experience, having worked in London and Stockholm. Torbjorn is mainly involved in overseeing Agilitas’s private equity investment activities and portfolio stewardship.

Torbjorn holds an MSc in Economics and Business Administration from NHH (Norway) and speaks Norwegian, Danish, Swedish, and English.

Portfolio

Danoffice IT

http://www.danofficeit.com/

DanOffice is a global value added reseller of Information Technology & Information Systems to international organisations and businesses operating worldwide. It provides IT hardware, services and solutions to international organisations working across borders, including developing and emerging markets.

Investment Rationale

DanOffice combines a stable and defensible customer base with a know-how for delivery into complex environments and deep supplier relationships, providing a strong platform for broadening the service offering and expanding the customer base.

Plan

Continue the development from a value added reseller, mostly focused on selling computer hardware, into a global Information Technology and Communications products and services provider to global clients.

Cibicom

https://www.cibicom.dk

Cibicom (previously Teracom Danmark) is the nationwide transmitter of digital terrestrial TV and radio and the sole independent telecom co-location operator through its tower infrastructure network.

Investment Rationale

Highly defensible business: reliability of transmission is key, demand is not discretionary, and pricing and competition are regulated by law. Cibicom is the only operator in Denmark with towers higher than 100 meters allowing digital terrestrial TV and radio broadcasters as well as mobile network operators to meet their government mandated universal coverage obligations cost-effectively. Cibicom owns a well-invested national network with significant opportunities for transformation.

Plan

Invest in and leverage the infrastructure network to drive growth from the exponential use of data consumption, in particular Data Centres and Internet of Things. Increase service offering.

Learning Curve Group

https://www.learningcurvegroup.co.uk/

Learning Curve Group ("LCG") is a leading UK training and education specialist. It provides more than 150 courses for 120,000 learners and 4,500 employers p.a. across a variety of sectors including Health & Social Care, Education, Business & IT, Hair & Beauty and Fitness. It offers life-changing opportunities, helping learners to improve their employability and economic well-being through practical education.

Investment Rationale

Highly defensible and stable long-term market dynamics have been created as the growing skills gap within the UK labour market causes pressure on the government to support workforce training through increasing funding allocations. The rising level of regulation drives quality, barriers to entry and opportunities for established players such as LCG. The company benefits from a flexible business model between: (i) distance and face-to-face training; and (ii) funding allocations, and has received "Good" or "Outstanding" OFSTED ratings across its business divisions.

Plan

Continue to invest in systems and programmes to drive the quality of training up. Develop new initiatives to capture more of the available funding and bring the exceptional education provided by LCG to a wider audience.

Integris Composites

https://www.integriscomposites.com/

Integris Composites is a global provider of lightweight, mission critical survivability and protection solutions for people working in hostile environments. Its portfolio of bespoke, highly engineered products covers personal protection as well as applications for land vehicles, aircraft and naval vessels, protects and saves soldiers' and law enforcement personnel's lives.

Investment Rationale

Integris Composites operates in the highly regulated survivability solutions industry with strong barriers to entry from required certifications. It has a unique market position as a transatlantic, independent global provider. Its facilities in Denmark, France and the United States hold individual certifications and national security clearances, making Integris Composites a strategic partner to the world's leading Original Equipment Manufacturers (OEMs), military and law enforcement agencies. With more than 30 years of experience in lightweight composite armour, Integris Composites is one of the only vertically integrated armour solutions providers with the ability to develop, test and manufacture products in-house.

Plan

Diversify key revenue lines and drive geographical expansion to provide even better protection for people working in hostile environments around the world. Implement further operational improvements.

Frontier Medical Group

https://www.frontier-group.co.uk/

Frontier Medical Group is a leading international designer and manufacturer of skin and wound care products, in particular ulcer prevention products, used by acute and community healthcare providers. The company’s focus on providing high-quality and clinically effective products reduces patients’ pain and discomfort, reduces time spent in treatment, and lowers the overall costs incurred by the healthcare system by preventing issues before they occur.

Investment Rationale

The skin and wound care sector has positive market dynamics, in particular due to the increasing demand for products that address issues related to ageing populations and rising rates of obesity. It enjoys significant defensibility, with positive regulatory forces and high barriers to entry, which have been enhanced by the European Medical Device Regulation. Frontier Medical Group has over 24 years' experience designing, and manufacturing clinically proven products and recent clinical studies have confirmed Frontier’s products as the gold standard for pressure ulcer prevention.

Plan

Expand the product range and increase the geographical reach further to have an even greater positive impact on patient outcomes and help reduce total treatment costs for health service providers.

Prodieco

https://www.prodieco.com/

Prodieco has been a leader in precision engineering for over 60 years, designing, manufacturing, and supplying bespoke precision blister tooling change parts for blister packaging lines for pharmaceutical, animal and consumer health market products globally. Prodieco helps address the growing demand for oral solid dose medication and the related growing regulation around safety. By doing so, it provides safer and more effective ways for patients to take their medication.

Investment Rationale

Prodieco benefits from positive market dynamics: increasing population, increasing use of medication and growing demand for oral solid dose medication and related blister packaging which support the conservation of drugs. The increasing regulation around pharmaceutical packaging aims to eradicate counterfeits or drug contamination and allows patients to rely on fault-free packaging. Prodieco’s unrivalled engineering expertise from decades of designing and manufacturing precision products equips it with a unique understanding and engineering insight into the best possible tool design for each unique format, where success is dependent on high integrity design and extremely precise manufacturing tolerances.

Plan

Implement further improvements to deliver operational excellence. Expand the precision tooling product and customer range to increase safety and efficiency for patients in adjacent sectors such as MedTech or biopharma. Enter new geographies.

Tidalis

tidalis.com

Tidalis (formerly Saab AB’s Maritime Traffic Management business) is a leading provider of mission-critical solutions for the global maritime sector. Its technology is used by governmental agencies such as port authorities or coast guards to improve shipping safety and efficiency.

Investment Rationale

Commercial marine shipping is a strategic part of global trade. The rising digitalisation of the maritime supply chain, regulatory standards, volume and diversity of vessel traffic, are driving the increasing need for reliable software solutions to manage the accrued complexity. Tidalis’s unique technological capabilities are used to operate some of the largest ports in the world, including Hong Kong, Shanghai and Los Angeles, and have enabled the company to build long-standing customer relationships globally.

Plan

Focus on maritime software as a standalone company with a dedicated management team. Develop Tidalis’s service offering, expand its global customer base and drive the transition to a SaaS platform.

Sanctuary & Seven Group

www.sanctuarypersonnel.com / www.seven-resourcing.com

Sanctuary & Seven is a specialist recruitment services company that provides essential health and social care staff in the UK and the US. It covers a wide range of placements in the public and private sectors across healthcare, social care and criminal justice sectors.

Investment Rationale

Sanctuary & Seven is well recognised for its innovative programs that significantly improve outcomes for vulnerable children and young adults. Local authorities and healthcare trusts, as well as private health and social care organisations, who must deliver on their care obligations, view the Group as a trusted long-term service delivery partner, helping them to address their increasing demand for health and social care services despite staffing shortages.

Plan

Help the Group develop innovative solutions, new technologies and efficient processes that maximise the positive impact on society. Develop the service offering and support the delivery of essential services.

Aeven

www.aevengroup.com

Aeven (formerly NNIT’s IT infrastructure outsourcing business) specialises in managing customers’ business-critical IT systems, providing full and customised outsourcing solutions including data storage, servers, networks and related advising and support services such as IT consulting services in relation to the cloud transition and cyber defense.

Investment Rationale

Aeven benefits from the exponential growth in data usage, strong digital transformation tailwinds and the increasing need for adjacent services such as cyber security. Legislation, privacy and security issues in regulated industries drive rising demand for Aeven’s local approach combined with the strategic locations of its data centres. The company’s activities are highly resilient, with embedded long-term relationships with large Danish blue-chip customers including banks and public entities with critical IT requirements.

Plan

Drive growth as a standalone company with a dedicated management team. Focus on offering more innovative products and services to a wider range of customers operating in complex environments.

Recover Nordic

https://recovernordic.com/

Recover is a leading supplier of Emergency Response and Damage Control services in the Nordic region, serving a wide range of customers, notably Insurance Companies .

Investment Rationale

Highly defensible business. The mostly non-discretionary need for the Company’s services is triggered by events like water and fire damage, resulting in a stable market with limited cyclicality. 70-80% of the market is served by the top 3 providers. Strong underlying market growth driven by urbanisation, population growth, and increase in property values.

Plan

Carve out and integrate the 3 country operations, expand into lateral geographies to create the Nordic market leader

Impetus

Impetus operates a traditional waste management business, a waste broking business and a small vehicle fleet. It is also the largest landfill operator in the North East, owning and operating two sites.

Investment Rationale

Highly regulated, resilient and non-cyclical industry. Since 1994, UK government policy has been to divert volumes away from landfill by not licensing new landfills and increasing landfill taxes therefore operators with green solutions for waste are better positioned to secure long term contracts.

Plan

Transform business from traditional waste management to green solution for waste.

Ionisos

Ionisos is the leading provider of cold sterilisation services in France and in Spain, serving a wide range of industries including healthcare and pharmaceuticals.

Investment Rationale

Highly defensible business displaying positive growth prospects. The service supplied is non-discretionary and mission critical to the customers, the cost of which represents a small proportion of the total product cost. Steady underlying market growth driven by regulation and increasing requirements for sterile products.

Plan

Transform the French/Spanish national market leader into an international group.

Reconor

Reconor

Reconor (formerly known as MH Gruppen) is one of the leading environmental services companies in Denmark, with a focus on the Copenhagen area. It is active in soil remediation and the collection, sorting, treatment and recycling of waste.

Investment Rationale

Soil Remediation is highly regulated in Denmark. Only companies with accredited sites at the right locations can provide these services. Underlying market growth driven by increasingly stringent regulation, higher recycling rate and pipeline of publicly-funded infrastructure construction projects.

Plan

Replicate unique business model and position achieved in the Copenhagen area in the rest of Denmark, transforming MH Gruppen into a national champion.

Exemplar Health Care

http://www.exemplarhc.com/

Exemplar is a leading UK provider of high acuity nursing care services for individuals with complex Physical and Mental Disabilities and Learning Disabilities. The business comprises 25 homes spread over 18 sites across Yorkshire, Humberside, the Midlands and the North West.

Investment Rationale

There is a growing need for private sector complex care provision in the UK. Exemplar specialises in high acuity residential Service Users for whom the alternative is often long-term hospital care. Providing residential care for complex cases is a highly defensible sector with significant barriers to entry.

Plan

Continue to focus on providing excellent quality of care. Support management in the improvement of systems and processes across the group. Provide capital to develop capacity supporting identified local needs.

Hydro International

https://www.hydro-int.com

Hydro International is a leading global provider of advanced products, services and technology for the treatment of wastewater and the control of stormwater, for municipal, industrial and construction customers.

Investment Rationale

Water management is an area of increasing government focus, as water scarcity grows in importance as a global issue, linked to increased population size, growing urbanisation and climate change. Hydro International is a technology leader in all its niches, and its customers rely upon the Company to improve their water management processes and operational performance, whilst reducing environmental impact. The company has a track record of growth and momentum with attractive financial characteristics, a strong management team and significant opportunities for transformation.

Plan

Accelerate the Company’s strategy to become a diversified global leader in its segments, and accelerate growth into services and industrial end markets.

As responsible investors we believe that the consideration of environmental, social and corporate governance factors throughout our investment process and during our stewardship of portfolio companies is both ethically right and fundamental to our investment strategy and to long-term value creation.

As private equity investors, we are in a unique position to help companies deliver a positive impact on society and the environment.

You can download a copy of the Agilitas 2024 Sustainable Value Creation Report here.

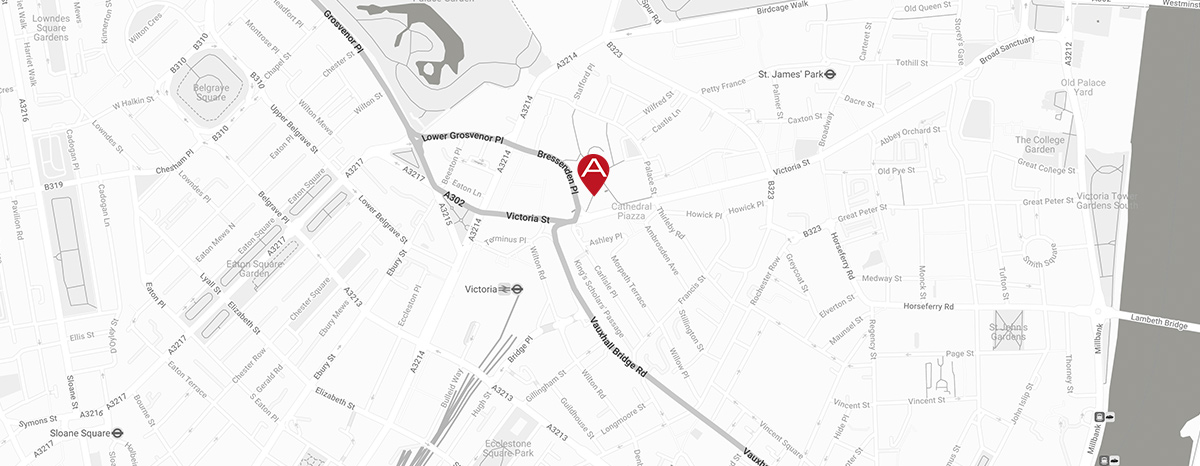

Agilitas,

7th Floor,

100 Victoria Street,

London,

SW1E 5JL

tel +44 20 3384 1111

To follow us on Linkedin please click here

To subscribe to our mailing list please click here

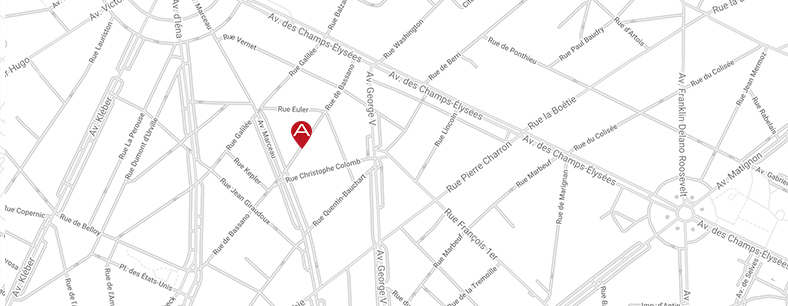

Agilitas

29, rue de Bassano

75008 Paris

France

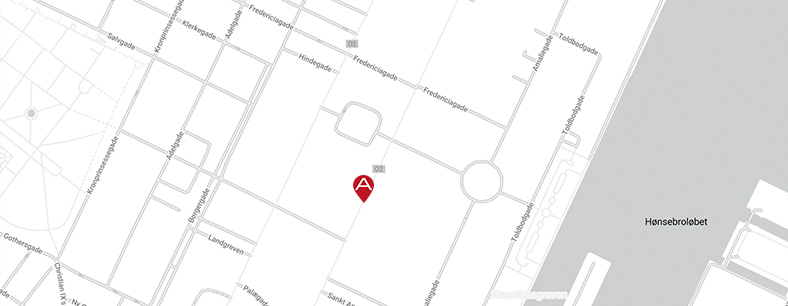

Agilitas

Bredgade 30

1260 Copenhagen

Denmark

Agilitas

5 Heienhaff

L-1769 Senningerberg

Luxembourg

+352 276 2351

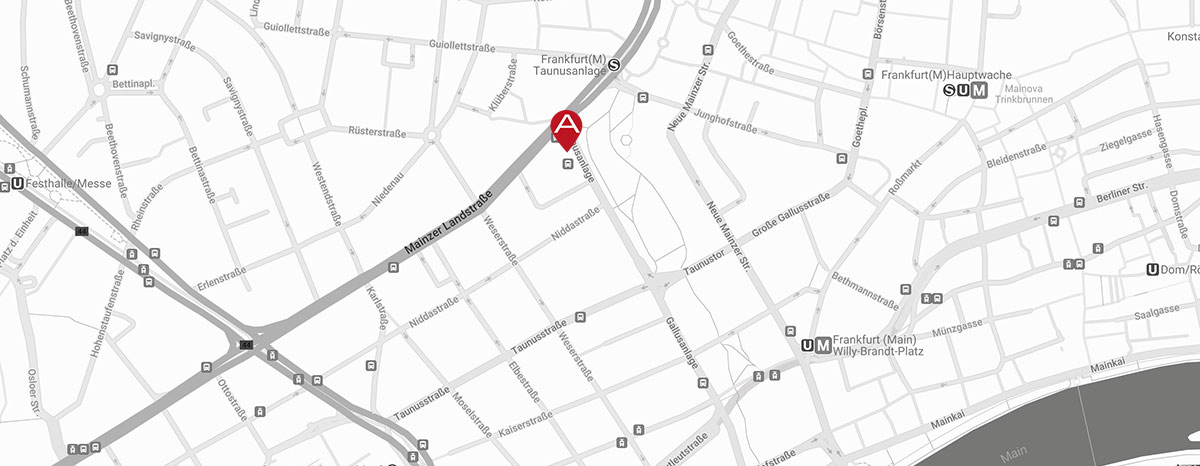

Agilitas

19th Floor of Marienturm,

Taunusanlage 9-10,

60329 Frankfurt am Main, Germany

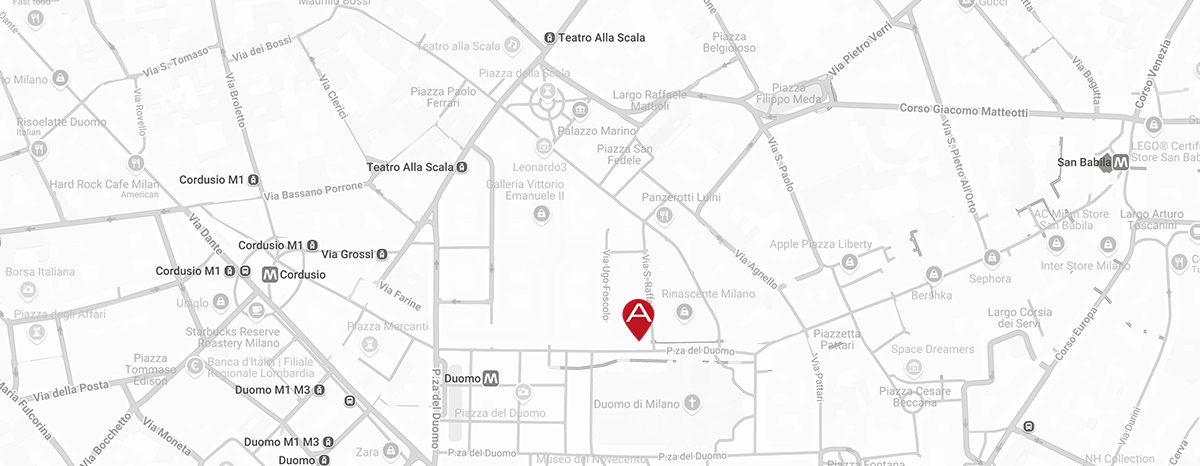

Agilitas

Via San Raffaele,1

20121

Milano

Office number 404

+39 02 00700351

Legal disclaimer

Disclaimer

To the fullest extent permitted at law, Agilitas Private Equity LLP is providing this website and the content on an ‘as is’ basis. This website is purely a public resource of general information about Agilitas Private Equity LLP. Although Agilitas Private Equity LLP intends that information contained on this website is correct, Agilitas Private Equity LLP does not represent, warrant or guarantee the accuracy, adequacy or completeness of any information, its fitness for any particular purpose or merchantability. In addition the information contained on this website may not be up to date. You acknowledge that any reliance you place on any information contained on the website shall be at your sole risk and that the existence of any inaccurate, inadequate, incomplete or out of date material on this website will not cause Agilitas Private Equity LLP to be in any way liable. Agilitas Private Equity LLP does not warrant that the functions contained in this website or third-party websites will be uninterrupted or without error, that defects will be corrected, or that electronic material in this website and other third-party websites are free from viruses or other harmful components.

Limitation of Liability

You agree to the fullest extent permitted by law neither Agilitas Private Equity LLP nor any of its directors, employees or other representatives will be liable for any damages, losses, claims, costs, expenses and other liabilities (including court and legal costs) arising out of the use of, or the inability to use, this website (including the contents, materials and functions of this website or any linked website), whether in contract, but (including negligence), breach of statutory duty or otherwise. This is a comprehensive limitation of liability that applies to all losses of any kind, including (without limitation) compensatory, direct, indirect, special, consequential damages, loss of data, income or profit, loss of or damage to property, business interruption and claims of third parties.

Copyright

This website and all content, including design, text, graphics, underlying source codes, software, applets, is the subject of copyright and is protected by copyright and/or other intellectual property laws and rights (including third-party rights). All rights reserved. You agree to comply with all copyright and other intellectual property laws during use of this Website (and/or the Content) and agree not to permit any act which infringes any of those rights. Without prejudice to the generality of the foregoing, you specifically acknowledge that you will not permit any unauthorised copying or use of the content unless you have obtained the prior written consent of Agilitas Private Equity LLP.

Third Party Sites

For the convenience of users, this website may provide hyperlinks to other websites operated by third parties. If you use these other websites, you will leave this website. If you decide to visit any linked website, you agree that you do so entirely at your own risk and it is your responsibility to take all protective measures to guard against viruses or other destructive elements. You accept that Agilitas Private Equity LLP has no control over, and is not responsible for, any material on any third party websites. You may be required to comply with all requirements of any third party over the conditions of use of that party’s website. Agilitas Private Equity LLP makes no warranty or representation regarding, and does not endorse, any linked websites or the information appearing thereon or any of the products or services described. Hyperlinks do not imply that Agilitas Private Equity LLP is affiliated or associated with, or is legally authorised.

PRIVACY POLICY

At Agilitas Partners LLP, Agilitas Private Equity LLP and Agilitas Private Equity Services Limited (together “Agilitas”, “we”, "us", "our"), we are committed to handling information about you responsibly and we recognise and respect your right to privacy.

This Privacy Policy applies to individuals who use this website or engage with us as part of our provision of services as set out in this website.

This Privacy Policy describes the types of personal information we collect about you, how we may use that information and with whom we may share it. It also describes the measures we take to protect the security of your personal information and how you can reach us to answer any questions you may have about our privacy practices.

This Privacy Policy may be updated by us at any time and any updated policy will be effective once posted on the website.

About Us

Our principal place of business is at:

7th Floor,

100 Victoria Street,

London,

SW1E 5JL

We are a controller for the purposes of the applicable privacy laws in the jurisdictions in which we operate, including the General Data Protection Regulation 2016/679 (“GDPR”). This means in relation to the personal information you provide to us or that we receive about you during the course of our business dealings, we will determine why and how it is used.

What personal information we collect

When you use our website or during the course of our business dealings with you or your employer, we may collect your “personal information”.

Personal information is information that either alone or in combination with other information can directly or indirectly identify you.

Examples of personal information collected by us include your name, employer/company, job title, telephone number, address, email address, information regarding your job and/or other information regarding your preferences where it is relevant to the advisory services that we provide whether to funds, investee companies of funds (our “portfolio companies”) and/or investors of funds, or your employment or potential employment with us or our portfolio companies.

How we collect your personal information

We may collect your personal information in circumstances such as:

- when you provide it to us directly (i.e. when you contact us via email or provide us with a business card); and

- from a third party source (e.g. from a company for whom you work, other organisations with whom you have dealings, government agencies, a credit reporting agency, a recruitment agency, an information or service provider or from a publicly available record)

If you provide us with any personal information (whether that information relates to you or to someone else, such as one of your directors, employees or someone with whom you have dealings), it is your responsibility to ensure that you are entitled to disclose that information to us, and that, without us taking any further steps required by applicable data protection laws we may collect, use and disclose that information for the purposes described in this Privacy Policy.

If you do not provide information requested by us from time to time, we may not be able to provide services to you or your employer, or otherwise fulfill the purpose for which we have requested the information.

How we use your personal information

We use personal information in order to provide our services and to perform our obligations in relation to our business dealings with you. We may collect, record, store, use and/or disclose your personal information on the basis that it is:

- necessary to fulfill a contract we have with you or your employer;

- necessary for compliance with our legal and regulatory obligations;

- necessary for our legitimate commercial interests or those of any third party recipients that receive your personal data; and/or

- based on your consent. Where you give us your consent: we only ask for your consent in relation to specific uses of personal information where we need to and, if we need it, we will collect it separately and make it clear that we are asking for consent. You can withdraw your consent at any time.

Examples of the ways in which we may use information about you include:

- to provide you or your employer with our services and related information;

- to manage our business relationship with you, including to invite you to events;

- to improve our services and communications to you;

- for the purposes of employment, partnership or the supply or retention of services;

- to assess actual and/or potential transactions;

- to assess your suitability for involvement in future transactions;

- to comply with our legal and regulatory obligations, including assessing and managing risk and to comply with Know Your Customer and anti-money laundering obligations;

- for our insurance purposes;

- to process your requests of, and applications to, us;

- to record and monitor your use of this website for internal purposes which may include analysis of usage, measurement of site performance and generation of marketing reports;

- to send you periodic newsletters, updates or press releases where we have received your consent to do so, or we believe that you may be interested in the material as it relates to similar services you have previously used, or indicated your interest in using, from us;

- to store it in an internal database that we maintain of business contacts;

- where it is reasonably necessary for the establishment, exercise or defense of a legal or equitable claim, or for the purposes of a confidential alternative dispute resolution process; and

- for any other purpose for which this information was provided to us or for any purpose related or ancillary to any of the above.

Keeping your personal information secure

We will take appropriate measures to keep your information confidential and secure in accordance with our internal procedures covering the storage, access and disclosure of information.

Transferring Information About You Abroad

Your data may be transferred to and stored outside the EEA as well as within it.

You should be aware that in territories outside the EEA, laws and practices relating to the protection of personal data are likely to be different and in some cases many not offer the same level of protection as within the EEA.

We will ensure that any such international transfers are made subject to appropriate or suitable safeguards as required by applicable data protection law. To find out more about the safeguards we have in place to protect your personal information please contact us as info@agiltiaspe.com.

How long we retain your personal information

We will retain your personal information until it is no longer required for the purposes for which it was obtained, and otherwise so we can comply with any applicable laws, regulations or rules.

Updating Information About You

If any of the information that you have provided to us changes, for example if you change your email address or if you wish to cancel any request you have made of us, please let us know by sending an email to info@agilitaspe.com.

Your Rights

You may have certain rights over your personal information under applicable data protection laws. You will not be able to use these rights in all circumstances. Where applicable, you have the right to (i) reasonably access the personal information that we hold about you and (ii) review and correct such personal information.You may also be entitled to request that we provide personal data to you in a format which can be transferred for use by an alternative service provider or that we delete your personal information. To help protect your privacy, we take reasonable steps to verify your identity before granting access to your information.

If you have given your consent to process your personal information, you also have the right to withdraw such consent at any time. We will continue to process your information for other purposes.

If you would like to exercise any of your rights in relation to our processing of your data, please contact us at info@agilitaspe.com. In some cases, if you ask us to stop processing your personal data we may not be able to continue to provide you with our services.

Complaints

If you wish to make a complaint about how we have handled your personal information, please contact us at the details below and we will investigate the matter.

If you are not satisfied with our response, or think we’re not processing your personal information in accordance with the law, you can escalate your complaint to the Information Commissioner's Office, Wycliffe House, Water Lane, Wilmslow, Cheshire, SK9 5AF. Or visit their website https://ico.org.uk.

How to contact us

If you have any queries about the contents of this privacy policy, or would like to raise a complaint or comment, please contact us at:

- Email: info@agilitaspe.com; and

- Mail: 7th Floor, 100 Victoria Street, London, SW1E 5JL

Cookies

What is a cookie?

A cookie is a small text file that a website saves on your computer or mobile device when you visit the site. It enables the website to remember your actions and preferences (such as login, language, font size and other display preferences) over a period of time, so you don’t have to keep re-entering them whenever you come back to the site or browse from one page to another.

What cookies will the site use and for what purposes?

Our website uses a number of different cookies to improve the user experience and help us see what is popular:

- Single session cookies. These enable the site to keep track of your movement from page to page in order to ensure that you will not be asked for the same information you have previously given during your visit to the site. Cookies allow you to proceed through the site quickly and easily without having to authenticate or reprocess each new area you visit. We may use the cookies to analyse user behavior, such as which pages have been visited during the session, in order to improve your overall experience, for example enabling us to determine and display more relevant content.

- Persistent cookies. These cookies enable us to collect information such as number of visitors to the site and pages visited in order to analyse user behavior. This information is collected in an anonymous form and will be collated with similar information received from other users to enable us to compile reports in order to develop and improve user experience by displaying more tailored and relevant content for example.

How long will the cookies remain on my computer?

The cookies will remain in the cookies file of your browser after the closing of the browser and will become active again when the site is reopened, until removed. The cookie(s) will be deleted after 10 days, but they can be deleted earlier at any time by you. The cookie(s) will not collect any information when you are not accessing the Site.

Third party cookies

The single session and persistent cookies are provided on our behalf by a trusted third party service provider to aid in the reporting of user behavior on the website. This behavior is analysed to provide an improved user experience. The information collected is not linked to personally identifiable information.

How to control cookies

You can control and/or delete cookies as you wish – for details, see aboutcookies.org. You can delete all cookies that are already on your computer and you can set most browsers to prevent them from being placed. If you do this, however, you may have to manually adjust some preferences every time you visit a site and some services and functionalities may not work.

Marketing Communications

We send you periodic newsletters and other updates that we think would be of interest to you. If you do not want to receive these emails or communications, please just let us know by emailing info@agiltiaspe.com or clicking the unsubscribe link at the bottom of any of our emails.

Who else might receive your personal information

We will not disclose your personal information to third parties without your prior consent, except as detailed in this Privacy Policy or where a government, regulatory body or the law requires or allows us to disclose your personal information.

We share or disclose personal information when necessary to provide services or conduct our business operations as described below. When we share personal information, we do so in accordance with data privacy and security requirements. Below are the parties with whom we may share personal information and why.

- Our third-party service providers: We partner with and are supported by service providers some of which are located outside the EEA. We will make personal information available to our service providers only when necessary to fulfil the services they provide to us, such as software, system and platform support; cloud hosting services; advertising; data analytics; and order fulfilment and delivery. Our third-party service providers are not permitted to share or use personal information we make available to them for any other purpose than to provide services to us.

- Third parties for legal reasons: We may disclose personal information to:

- comply with legal obligations and respond to requests from government agencies, including law enforcement and other public authorities, which may include such authorities outside your country of residence.

- protect our rights, users, systems and services.

- our attorneys, accountants, consultants and advisors where such disclosure is connected with the provision of our advisory services related to specific transactions.

- buyers or successor managers of a fund and their professional representatives as part of any restructuring or sale of our business or assets.

- tax authorities who are overseas for instance if you are subject to tax in a different jurisdiction to the fund, we may share your personal information directly with relevant tax authorities (instead of through the local authority).

Last updated December 2019